Real estate investment can be a powerful tool for building wealth and achieving financial freedom. By strategically investing in properties, you generate passive income streams that expand over time. The appreciation of property values adds another layer of potential to your investment portfolio.

Beyond the financial benefits, real estate possession offers a sense of security and stability. It provides a tangible asset that you can cultivate, unlike intangible investments that fluctuate in value. Owning property also enables you to build equity, which can be used for future goals such as funding education or retirement.

- For maximize your returns, consider diversifying your portfolio with a mix of residential and commercial properties.

- Carry out thorough research before making any investment decisions.

- Partner with experienced real estate professionals who can guide you through the process.

Amplify Your Investments: A Guide to Real Estate Investing for Beginners

Stepping into the world of real estate investing can seem daunting, but with the right knowledge and strategy, it can be a rewarding journey. This guide is designed to prepare you with the fundamental understanding needed to navigate the arena. First and foremost, determine your investment goals. Are you looking for reliable income through rental properties, or are you aiming for significant capital appreciation?

Once your visions are clear, it's time to explore different real estate alternatives. Consider factors such as location, property category, and market trends. Building a strong network of professionals can also be invaluable.

Remember, successful real estate investing requires thorough investigation and a disciplined approach. By adopting these best practices, you can set yourself up for success in this dynamic market.

Unlocking Wealth with Real Estate's Passive Income Power

Real estate has established itself as a solid investment, offering both appreciation potential and a steady stream of revenue. While active investing requires constant monitoring, passive income from real estate {allows you tobuild wealth whilesleeping. This can be achieved through various approaches, such as renting out properties or investing in real estate investment entities. Passive income from real estate provides {financial freedom|a safety net|the opportunity to{achieve your financial goals faster.

- Building equity through property ownership over time.

- Creating a steady stream of revenue from rent payments.

- Leveraging tax benefits associated with real estate investments.

Real Estate: A Legacy Investment for Future Generations

Real estate offers itself as a time-tested method to secure a lasting legacy for generations to succeed. Its concrete nature provides a feeling of stability and permanence, unlike shifting assets that can decline.

Investing in real estate facilitates you to establish wealth that surpasses your lifetime, leaving a valuable possession for your heirs. The opportunity for growth over time makes real estate a sensible choice for long-term financial planning.

Furthermore, owning real estate can provide passive income through rentals, moreover solidifying its attraction as a multi-generational wealth creator.

Even in Real Estate Still Reigns Supreme in a Shifting Market

In this ever-changing market, it can be challenging to figure out which investments will prosper. Nevertheless, real estate continues to prove its value as a stable investment.

Real estate's historical significance can be attributed to several elements. Primarily, it provides a physical asset that maintains value over time. Unlike volatile financial markets, real estate is anchored in the physical realm.

Moreover, real estate produces passive income through leases. This consistent stream of revenue can supplement your overall financial portfolio. In addition to the financial benefits, real estate can also provide a sense of security.

Owning a home can be a source of satisfaction.

Real Estate Investing: Strategies for Building a Secure Financial Future

Investing in real estate can be a lucrative way to build wealth and secure your financial future. A well-chosen property can appreciate in value over time, providing you with a significant return on your investment. Furthermore, rental income from real estate provides a steady stream of passive income, helping you achieve financial independence.

To maximize your returns and minimize risks, it's essential to develop sound real estate investing approaches. Conduct thorough market research to find check here promising neighborhoods with high demand and potential for growth. Evaluate different property types, such as residential homes, commercial buildings, or land development projects, based on your investment goals and risk tolerance.

Creating a strong network of professionals, including real estate agents, lawyers, and contractors, is crucial for navigating the complexities of the market. Furthermore, remember to factor in all associated costs, such as property taxes, insurance, and maintenance expenses, when assessing potential investments.

Ariana Richards Then & Now!

Ariana Richards Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Sydney Simpson Then & Now!

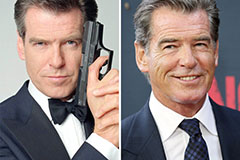

Sydney Simpson Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!